Market Trends

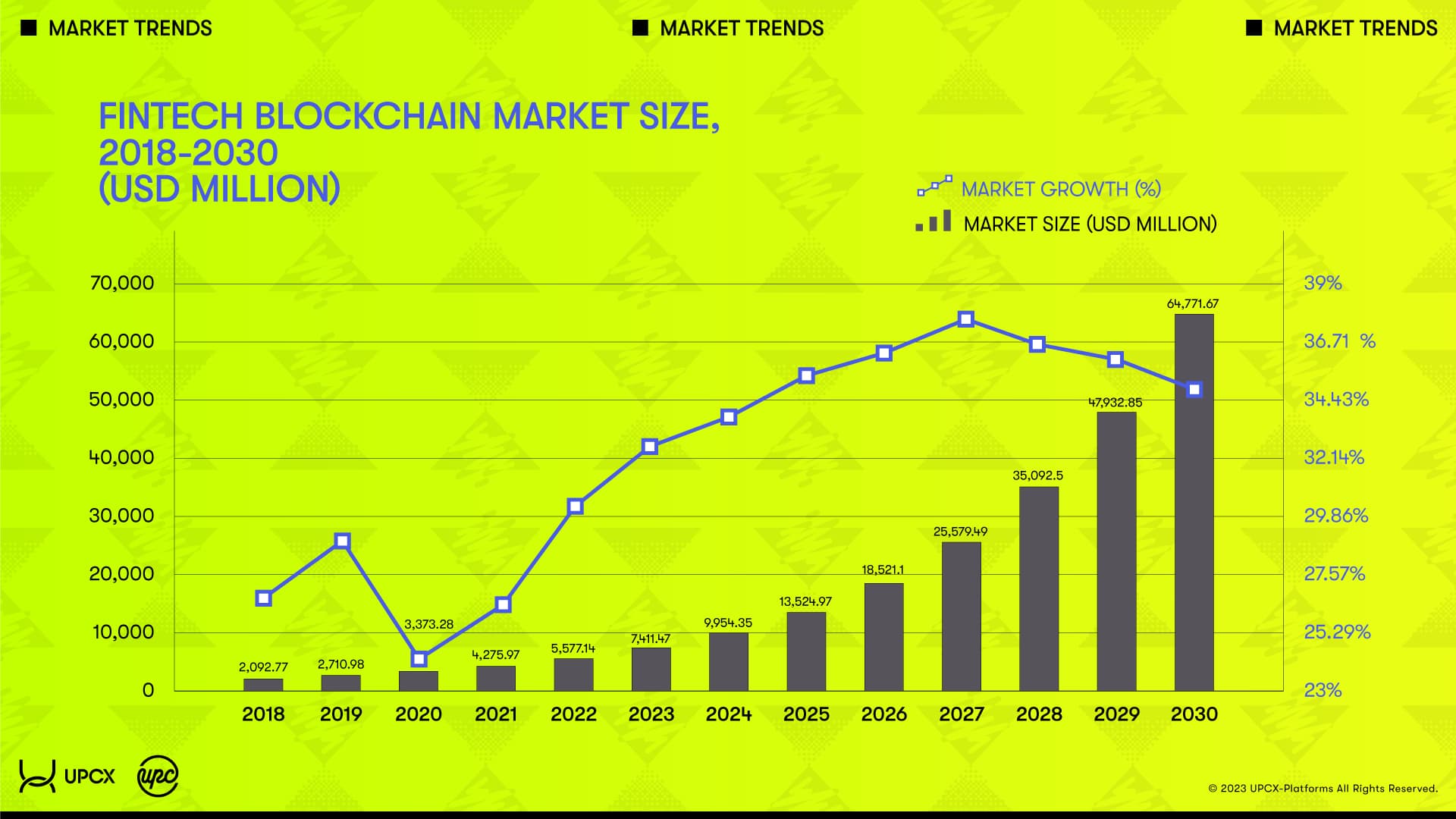

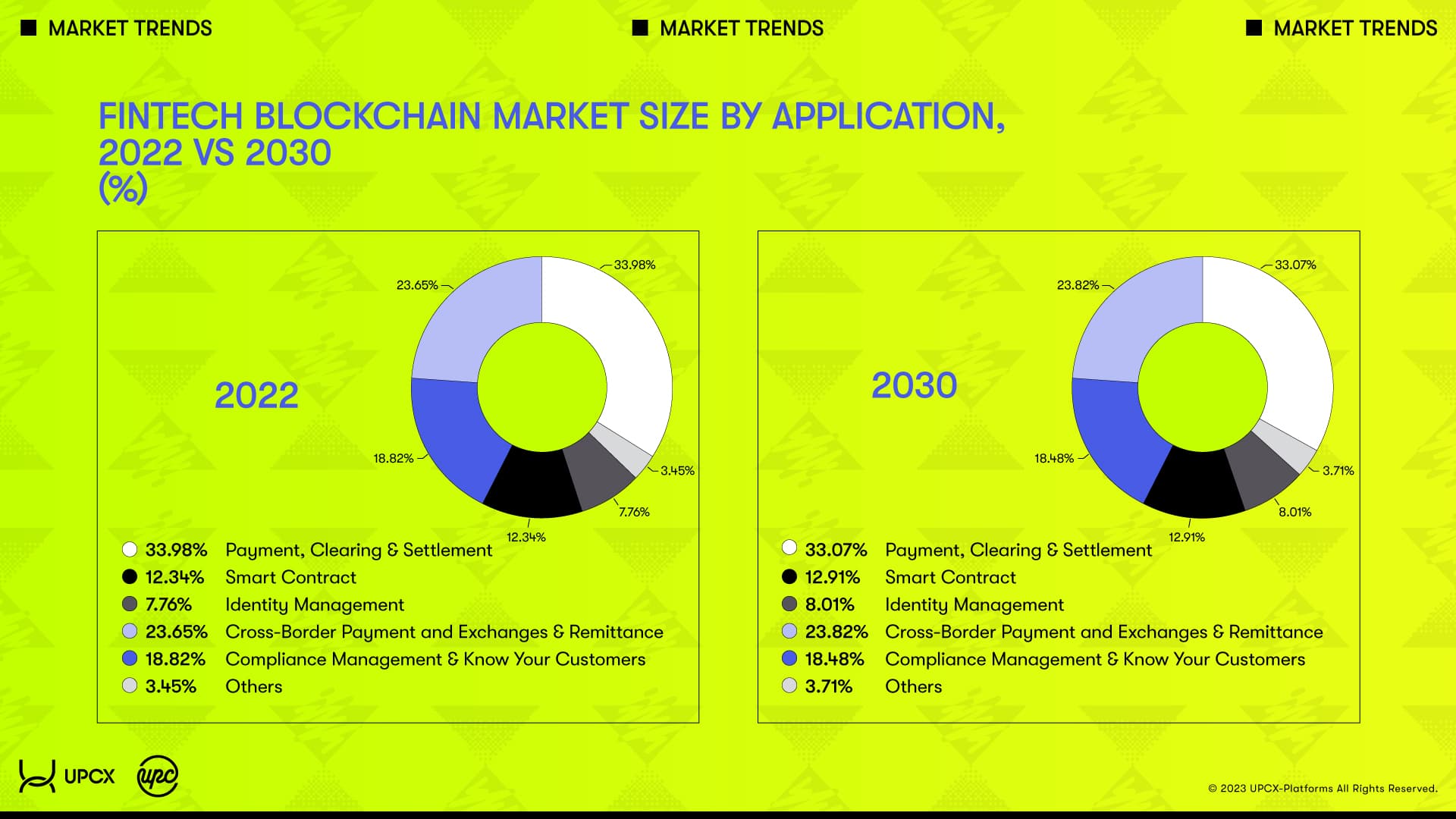

According to 360iResearch, the fintech blockchain market, is currently valued at USD 5.5 billion, and is expected to grow at an annual rate of 36% to become a USD 64.7 billion market by 2030. Looking at a breakdown of the market, UPCX’s core domains of “Payment, Clearing & Settlement” and “Cross-Border Payment and Exchange & Remittance” are expected to maintain the biggest share of around 57% until 2030. This translates in an expected significant growth in the UPCX related fintech blockchain market, reaching USD 36.8 billion in 2030 up from USD 3.2 billion in 2022.

The expansion of the fintech blockchain market is thought to be mainly driven by the private sector, but recent movements in the public sector like the issuance of CBDC (Central Bank Digital Currency) are also noteworthy.

According to a report by the Atlantic Council, starting with the Bahamas who issued the world's first CBDC in October 2020, 11 countries have already completed CBDC issuance and are in operation mode. With countries and economic unions like Japan, the United States of America, China and the EU also developing and testing the possibilities of CBDCs, this trend is considered to be irreversible.

It is said that Diem (formerly Libra), which Meta (formerly Facebook) considered issuing, was behind the growing momentum for CBDC research and issuance around the world. It all started with a sense of crisis in the public sector, when Meta – a giant representing the private sector – tried to take initiative in relation to financial flows such as payments and remittances. As XRP, which is issued by Ripple, also increased its presence in relation to cross-border transfers and overseas remittances, it seems that the public sector felt pressured to not fall behind even further.

In this way, by making full use of blockchain technology, the private sector challenged the established payment and remittance practices of traditional public sector main players, even taking the lead in some areas. Going forward, we expect that the private and public sector will continue to keep each other in check, while strengthening their respective advantages to compete with each other and complement each other, contributing to the expansion of the market.

Under such circumstances, it is not hard to imagine that the cryptocurrency that is used for payments and remittances is required to be stable in the short term, avoiding excessive fluctuations in value. Even today, stablecoins such as USDT issued by Tether are already taking this role, with demand to be expected to further grow as fintech and blockchain markets expand further.

Most of the stablecoins that are issued today are backed by fiat currencies. In other words, the private sector is still under the protection of the public sector. If just a handful of companies that were deemed to be sufficiently creditworthy were allowed to issue stablecoins, it would be difficult to achieve the decentralization advocated by Web3. In order to overcome this situation, stablecoins are needed that can be backed up and collateralized with various real world asset classes, such as commodities, and not depend solely on fiat currencies as a source of creditworthiness. Furthermore, there should be a platform that makes it easy for anyone to become a stablecoin issuer under certain conditions.